Catalysis

General information

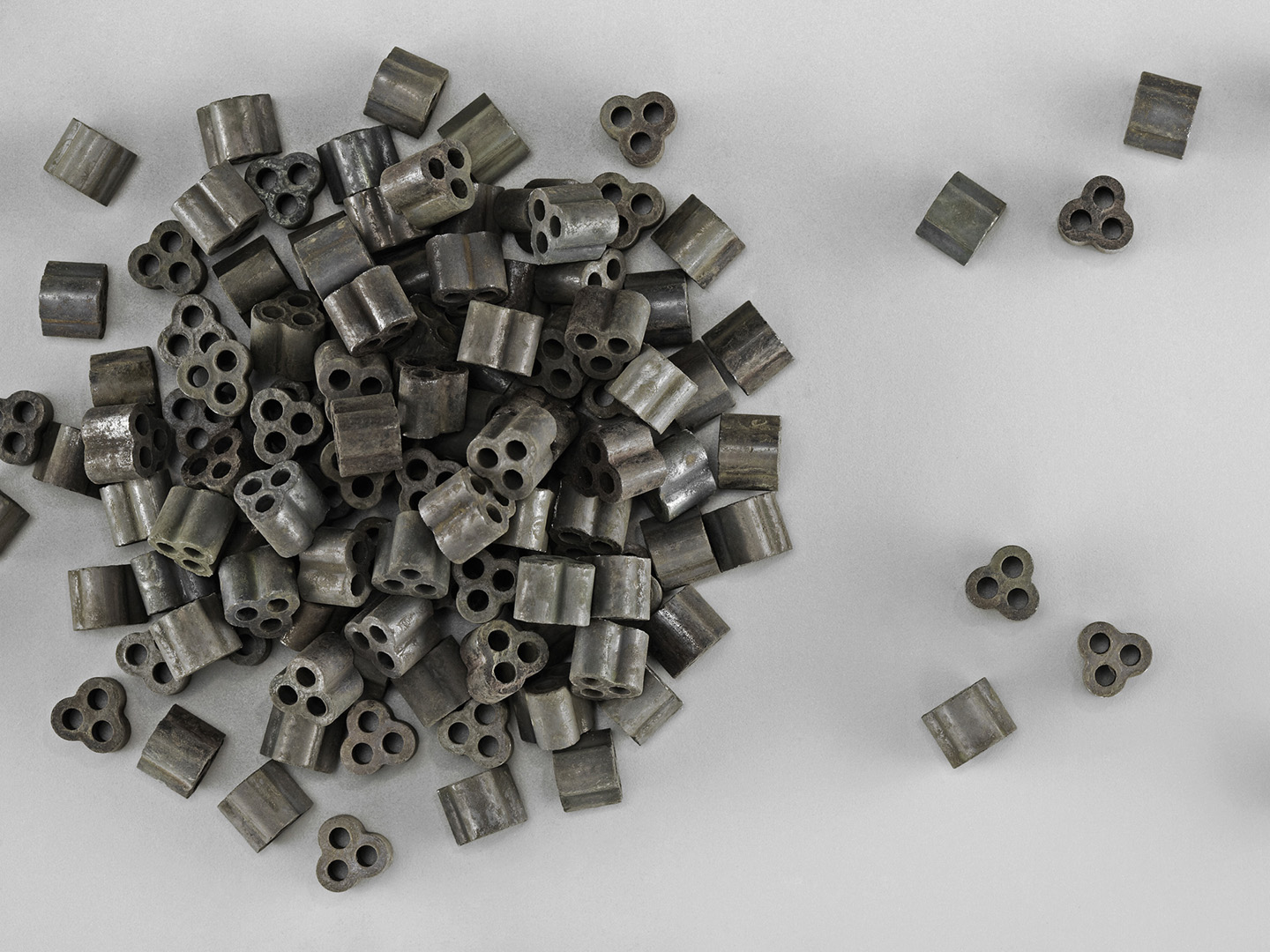

The Business AreaBusiness AreaFor the financial reporting, Clariant grouped its businesses in three core Business Areas: Care Chemicals, Catalysis, and Natural Resources. As of 1 January 2023, the Group conducts its business through the three newly formed Business Units Care Chemicals, Catalysts, and Adsorbents & Additives and will report accordingly as of the first quarter of 2023. Catalysis comprises the Business Unit Catalysts and the Business Line Biofuels & Derivatives. It develops, manufactures, and sells a wide range of catalyst products. They contribute significantly to value creation in its customers’ operations, making use of finite raw materials and energy efficiently and effectively, ensuring quality and yield of processes.

CATALYSIS IN THE 2022 FINANCIAL YEAR

OVERVIEW

Business AreaBusiness AreaFor the financial reporting, Clariant grouped its businesses in three core Business Areas: Care Chemicals, Catalysis, and Natural Resources. As of 1 January 2023, the Group conducts its business through the three newly formed Business Units Care Chemicals, Catalysts, and Adsorbents & Additives and will report accordingly as of the first quarter of 2023. Catalysis comprises Business Unit Catalysts and Business Line Biofuels & Derivatives. Products of Business Unit Catalysts are used for chemical production, fuel processing, and emission control. Its »custom catalysts« business helps customers to scale up and commercialize their new catalyst recipes. Business Line Biofuels & Derivatives complements the offering with sunliquid®, a groundbreaking technology to produce biofuels and biochemical intermediates from agricultural residues.

APPLICATIONS

Business Unit Catalysts

- Ammonia cracking

- Ammonia

- Custom catalysts

- Ethylene & derivatives

- Fischer-Tropsch

- Fuel cell

- Fuel upgrading

- Gas processing

- Hydrogen

- Hydrogenation

- Liquid hydrogen carrier

- Low-carbon ammonia

- Low-carbon methanol

- Methanol

- Methanol-to-propylene (MTP)

- Off-gas treatment for chemical plants and stationary engines

- Olefins purification

- On-purpose propylene

- Oxidation

- Polypropylene

- Refinery stream purification

- Styrene

- Zeolite powders

Business Line Biofuels & Derivatives

- Biocatalysis

- Cellulosic ethanol

- Cellulosic sugars

- Low-carbon advanced biofuels

- Residue-derived biochemical intermediates

PRIORITY SDGs

- SDG 7 Affordable and Clean Energy

- SDG 9 Industry, Innovation, and Infrastructure

- SDG 12 Responsible Consumption and Production

- SDG 13 Climate Action

The business area profits from several business drivers:

- the need to increase energy efficiency and sustainability in chemical production;

- the desire to decarbonize the chemical as well as the transport sectors;

- the search for sustainable, emission-free mobility solutions;

- growing interest in circular-economy solutions through the extensive use of renewable resources;

- increasing legal and regulatory requirements for renewable energy sources.

The Business AreaBusiness AreaFor the financial reporting, Clariant grouped its businesses in three core Business Areas: Care Chemicals, Catalysis, and Natural Resources. As of 1 January 2023, the Group conducts its business through the three newly formed Business Units Care Chemicals, Catalysts, and Adsorbents & Additives and will report accordingly as of the first quarter of 2023. Catalysis has 16 production sites (including joint ventures), 21 sales offices, and 11 contract R&D centers around the world.

Business Unit Catalysts

Building on a 165-year history, Business Unit Catalysts is a global catalyst manufacturer of energy-efficient technologies shaping a sustainable future for the chemical industry. The Business Unit Catalysts helps to decarbonize its customers’ production processes and scale up the transition toward zero-emission chemicals and fuels. Through exceptional R&D and established expertise, its broad portfolio of catalysts and adsorbents provides innovative solutions that increase production throughput, lower energy consumption, and reduce hazardous emissions from industrial processes.

For example, the emission-control EnviCat®-S catalysts series removes harmful chemical compounds with an excellent conversion efficiency. The EnviCat®-S catalysts series also helps customers meet strict new regulations concerning the improvement of air quality around the world. Another example is the catalyst AmoMax® 10 Plus, a new wustite-based catalyst that contributes to a more sustainable and profitable production of green ammonia. It delivers stable and reliable performance so that green ammonia producers maximize yields while minimizing operating expenses. And Clariant’s tailor-made structured catalysts used in the award-winning EARTH® technology help to improve the efficiency of hydrogen production: EARTH® is proven to increase hydrogen yield by up to 20 %, while decreasing CO2 emissions by up to 10 % and reducing makeup fuel consumption by up to 50 % per unit of hydrogen produced.

Business Line Biofuels & Derivatives

Biotechnology provides unique opportunities for Clariant to meet its customers’ demand for more sustainable production chains and for energy supply on a renewable basis. The business line’s flagship product is the sunliquid® technology, which converts agricultural residues into cellulosic ethanol, a second-generation biofuel.

As of January 2023, the former Business AreaBusiness AreaFor the financial reporting, Clariant grouped its businesses in three core Business Areas: Care Chemicals, Catalysis, and Natural Resources. As of 1 January 2023, the Group conducts its business through the three newly formed Business Units Care Chemicals, Catalysts, and Adsorbents & Additives and will report accordingly as of the first quarter of 2023. Catalysis is replaced by the new Business Unit Catalysts, which now also includes the former Business Line Biofuels & Derivatives as one of its segments. This reorganization is part of the simplified organizational and leadership structure that is outlined in greater detail in the chapter »Business model and strategy – organizational structure.«

Market dynamics in 2022

2022 was an exceptionally challenging year. The war on Ukraine caused a major energy crisis that contributed to inflation of input costs. The strict zero COVID-19 policy in China depressed economic activity. Internationally, a long period of record-low interest rates came to an end. All chemical sectors in Europe relying on natural gas for energy and as a feedstock – such as ammonia and methanol – were challenged.

Regions with advantaged feedstock costs and ample hydrocarbon resources, such as the Middle East and North America, are profiting from the new energy environment. BU Catalysts, as a global player with a broad portfolio, can take advantage of the shifts in the chemical industry and grow with the advantaged regions.

The ongoing energy crisis has further accelerated the energy transition, as can be seen from the pace of project announcements. The Business Unit Catalysts is well positioned to capture these opportunities through its portfolio of technologies for conversion of green hydrogen.

How the Business Area Catalysis created value in 2022

In the full year 2022, sales in the Business AreaBusiness AreaFor the financial reporting, Clariant grouped its businesses in three core Business Areas: Care Chemicals, Catalysis, and Natural Resources. As of 1 January 2023, the Group conducts its business through the three newly formed Business Units Care Chemicals, Catalysts, and Adsorbents & Additives and will report accordingly as of the first quarter of 2023. Catalysis rose by 14 % in local currency and by 9 % in Swiss francs. This growth was mainly volume-driven. In response to the cost developments mentioned above, Clariant implemented price increases across its catalysts portfolio.

In 2022, the EBITDAEBITDAEarnings before interest, taxes, depreciation, and amortization. margin decreased to 9.4 % from 16.8 % in the previous year. The main factors impacting this development included: (1) project cost and higher operational cost related to the new sunliquid® production plant in Romania; (2) a less favorable product mix during the first nine months of 2022, with a lower share of accretive Petrochemicals and Syngas catalyst sales and the suspension of all business with Russia; (3) temporary margin squeeze, which continued into September, due to pressure from raw material (peak in the second quarter of 2022), energy, and logistics cost.

Clariant’s energy-efficient catalyst technologies made a significant contribution to climate protection in 2022. They enabled the emission reduction of more than 35 million tons of carbon dioxide equivalent (CO2e) in customers’ processes in the chemical industry.

A significant part of the emission reductions comes from customers in the steel industry, a sector otherwise responsible for 7 % of global CO2 emissions. Clariant’s reformer catalysts are used in the Direct Reduction of Iron (DRI) process of iron production, which in turn feeds into the production of steel.

Another key contributor is Clariant’s solutions for the catalytic abatement of nitrous oxide (N2O) emitted during the production of nitric acid. Clariant’s catalysts offer an economical solution for removing up to 99 % of nitrous oxide emissions by converting them into harmless nitrogen and oxygen.

New products

Clariant’s EcoCircle initiative supports the transition from a one-way plastics value chain toward a circular plastics economy. One way to do this is to use mixed plastic waste for the production of pyrolysis oils, a feedstock for valuable chemicals. Launched in October 2022, Clariant’s new HDMax® catalysts and Clarit™ adsorbents are designed for the purification of theses pyrolysis oils. Used together, the adsorbents extend the life of the catalyst by reducing impurities in the production process. Producers benefit from highly efficient impurity removal to achieve pyrolysis oil that is compatible with ethylene plants. See also the Natural Resources chapter

New initiatives

The Business AreaBusiness AreaFor the financial reporting, Clariant grouped its businesses in three core Business Areas: Care Chemicals, Catalysis, and Natural Resources. As of 1 January 2023, the Group conducts its business through the three newly formed Business Units Care Chemicals, Catalysts, and Adsorbents & Additives and will report accordingly as of the first quarter of 2023. Catalysts supports the decarbonization of the chemical industry in various ways. For example, catalysts play a major role in the production of so-called green ammonia, which is produced using renewable energies. Clariant will supply a new green ammonia plant by KBR in Duqm, Oman, with its next-generation AmoMax® 10 Plus ammonia synthesis catalyst. Once completed, the plant will use solar and wind energy to produce 300 tons of ammonia per day, avoiding 270 000 tons of CO2 each year compared to an average traditional ammonia plant. Clariant also supplies another groundbreaking green ammonia project in Australia with its award-winning AmoMax® Casale ammonia synthesis catalyst. The joint project of The Hydrogen Utility and Case starts with the construction of two pilot plants that will avoid around 100,000 tons of CO2 per year.

In November 2021, Clariant launched a global climate campaign to reduce nitrous oxide (N2O). N2O is a by-product of nitric acid production and around 300 times more harmful to the climate than CO2. Of the approximately 500 nitric acid plants operating globally, more than half run without N2O abatement. Such producers without abatement were able to apply for a free first fill of Clariant’s EnviCat® N2O-S catalysts. These catalysts remove up to 95 % of N2O generated in nitric acid production.

Clariant’s SynDane® catalysts will be used in one of the world’s largest plants for maleic anhydride, an important base material for biodegradable plastics. The plant by Wanhua Chemical Group is located in China’s Shandong province and will commence operations in 2023. It will be the first plant to use a new production technology, which includes the use of SynDane® catalyst. The increased efficiency of the production process results in planned energy savings of up to 24 000 MWh each year.

Certifications and awards

In June 2022, the American Chemistry Council (ACC) awarded Clariant with the Sustainable Leadership Award 2022 in the category »Environmental Protection.« The accolade is in recognition of Clariant’s global climate initiative for N2O reduction (see above).

In October 2022, Clariant and its engineering and technology partner Technip Energies received two industry awards for the groundbreaking EARTH® technology: EARTH® was selected as the »Best Process Innovation« in the ICIS Innovation Awards 2022 and as the winner in the »Best Refining Technology« category of the Hydrocarbon Processing Awards 2022. In parallel, EARTH® was installed at a large-scale hydrogen plant in one of Europe’s biggest refineries, resulting in an expected increase in production capacity of up to 20 %.

Academic partnerships

Clariant has partnerships with prominent global academic institutions. For example, the strategic academic cooperation of Clariant and the Technical University of Munich, called »MuniCat,« has brought about more than 30 completed projects since its inception in 2011. »MuniCat« has been saving innovative intellectual property and technical know-how for Clariant and has been crucial in developing improved and new catalyst systems. Clariant and the Technical University plan to further cooperate to develop new catalyst technologies for trendsetting sustainable transformations. The research cooperation with the ETH Zurich is another example of Clariant’s academic partnerships. Clariant has awarded the winners of the ETH Talent program for their outstanding research in the field of Catalysis with the aim of supporting the sustainable transformation in the chemical industry.

Ongoing developments

Clariant has been participating in a project for more efficient hydrogen transport since the end of 2021. Project »AmmoRef« is funded by the German Federal Ministry of Education and Research in the amount of EUR 14 million. It aims to develop ammonia-cracking catalysts and processes capable of industrial-scale and long-distance hydrogen transport. Converting hydrogen to ammonia for transportation and cracking ammonia back into hydrogen at the point of use is an economically viable transportation method. Clariant’s role in AmmoRef is to use its profound knowledge of the chemical reactions and catalytic processes to develop new and improved generations of its existing ammonia-cracking catalysts.

Business Area Catalysis

6.5 %

R&D spend of sales

> 95

Active innovation projects

725

Number of raw materials procured

316.8

Raw materials procured in CHF m

15

Production sites

551

Raw material suppliers

29 248

Training hours

626.7

Energy consumption in m kWh

989

Sales in CHF m

9.4 %

EBITDAEBITDAEarnings before interest, taxes, depreciation, and amortization. margin

0.06

Production volume in m t

14 %

Growth in local currencies

2 161

Staff in FTEs at year-end

34.0

Waste in thousand t