The compensation structure for members of the Board of Directors follows the outlined compensation concept for the performance year 2016.

According to the aforementioned guidelines, remuneration of members of the Board of Directors is made up of the following components:

a) Annual basic fee

b) Committee membership fees

c) Share-based remuneration

Since the performance year 2012, the Board of Directors has decided to abandon option-based compensation for non-executive directors. It was replaced by the grant of restricted stock to enable the Board to participate in the long-term value creation of the company. In addition, a new compensation policy was implemented with effective date 1 April 2012, which focuses more on a stronger acknowledgment of responsibilities and activities inside the committees. The design principles as well as the overall remuneration of the Board of Directors have been kept unchanged since the performance year 2012.

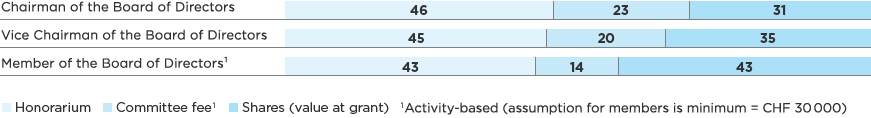

The following graph illustrates the relative structure of the three components for 2016:

Relative Structure of Total Compensation (Board of Directors) in % of total compensation

|

Chairman of the Board |

Vice Chairman of the Board |

Member of the Board of Directors |

Total 2016 |

Total 2015 |

|||||||||||

|

||||||||||||||||

Cash compensation |

|

|

||||||||||||||

Honorarium1 |

300 000 |

200 000 |

100 000 |

1 200 000 |

1 100 000 |

|||||||||||

Committee fee1 |

According to individual activity (see table below) |

730 000 |

730 000 |

|||||||||||||

Social contribution |

|

|

||||||||||||||

Relevant amount |

According to individual situation2 |

|

|

|||||||||||||

Shares |

|

|

||||||||||||||

Value (at grant)3 |

200 000 |

150 000 |

100 000 |

1 050 000 |

950 000 |

|||||||||||

|

Chair |

Member |

||

Chairman’s Committee |

120 000 |

60 000 |

||

Audit Committee |

80 000 |

40 000 |

||

Compensation Committee |

60 000 |

30 000 |

||

Technology & Innovation Committee |

60 000 |

30 000 |

In order to fulfill the reporting needs outlined in the Ordinance against Excessive Compensation (OaEC) the relevant Fair Market Value (FMV) figures as earned by the BoD members for the calendar year are disclosed in the following audited table.

|

Rudolf Wehrli |

Günter von Au |

Peter Chen |

Hariolf Kottmann1 |

Eveline Saupper |

Carlo G. Soave |

Peter Steiner |

Claudia Suessmuth Dyckerhoff |

Susanne Wamsler |

Konstantin Winterstein |

Former BoD Members3 |

Totals 2016 |

||||||||||||

Cash compensation |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Honorarium |

300 000 |

200 000 |

100 000 |

0 |

75 000 |

100 000 |

75 000 |

75 000 |

100 000 |

100 000 |

25 000 |

1 150 000 |

||||||||||||

Committee fee |

150 000 |

130 000 |

60 000 |

0 |

52 500 |

150 000 |

105 000 |

0 |

30 000 |

10 000 |

42 500 |

730 000 |

||||||||||||

Social contribution |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Relevant amount4 |

39 164 |

31 773 |

18 004 |

0 |

15 422 |

48 3962 |

19 306 |

11 425 |

15 899 |

0 |

5 508 |

204 896 |

||||||||||||

Shares |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Fair market value (FMV) |

200 005 |

150 008 |

100 011 |

0 |

75 008 |

100 011 |

75 008 |

75 008 |

100 011 |

100 011 |

25 003 |

1 000 084 |

||||||||||||

Total 2016 (Fair market value 2016) |

689 169 |

511 781 |

278 015 |

0 |

217 930 |

398 407 |

274 314 |

161 433 |

245 910 |

210 011 |

98 011 |

3 084 980 |

|

Rudolf Wehrli |

Günter von Au |

Peter Chen |

Hariolf Kottmann1 |

Eveline Saupper |

Carlo G. Soave |

Peter Steiner |

Claudia Suessmuth Dyckerhoff |

Susanne Wamsler |

Konstantin Winterstein |

Former BoD Members3 |

Totals 2015 |

||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

Cash compensation |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Honorarium |

300 000 |

200 000 |

100 000 |

0 |

0 |

100 000 |

0 |

0 |

75 000 |

100 000 |

216 668 |

1 091 668 |

||||||||||||||||||||||

Committee fee |

150 000 |

100 000 |

60 000 |

0 |

0 |

127 500 |

0 |

0 |

22 500 |

40 000 |

213 334 |

713 334 |

||||||||||||||||||||||

Social contribution |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Relevant amount |

44 465 |

30 723 |

17 927 |

0 |

0 |

41 5812 |

0 |

0 |

10 302 |

0 |

38 592 |

183 590 |

||||||||||||||||||||||

Shares |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Fair market value (FMV)5 |

200 006 |

150 008 |

100 011 |

0 |

0 |

100 011 |

0 |

0 |

75 008 |

100 011 |

150 017 |

875 072 |

||||||||||||||||||||||

Total 2015 (Fair market value 2015)5 |

694 471 |

480 731 |

277 938 |

0 |

0 |

369 092 |

0 |

0 |

182 810 |

240 011 |

618 611 |

2 863 664 |

||||||||||||||||||||||

In both years there were no payments to former members of the Board of Directors after the mandate year nor were any loans or credits outstanding and/or granted.

Please find on the next page the information about the actual share and option ownership of the Board of Directors.

|

Number of shares granted for 20161 |

Number of shares granted for 20152 |

Number of privately held shares at 31 Dec. 2016 |

Number of privately held shares at 31 Dec. 2015 |

||||||||||||||

|

||||||||||||||||||

Rudolf Wehrli |

11 765 |

11 541 (correction of 11 765) |

66 438 |

54 897 |

||||||||||||||

Günter |

8 824 |

8 656 (correction of 8 824) |

44 212 |

35 556 |

||||||||||||||

Peter Chen |

5 883 |

5 771 (correction of 5 883) |

24 475 |

18 704 |

||||||||||||||

Hariolf Kottmann |

–3 |

–3 |

–3 |

–3 |

||||||||||||||

Eveline Saupper |

5 883 |

– |

6 000 |

na |

||||||||||||||

Carlo G. Soave |

5 883 |

5 771 (correction of 5 883) |

39 575 |

33 804 |

||||||||||||||

Peter Steiner |

5 883 |

– |

0 |

na |

||||||||||||||

Claudia Suessmuth Dyckerhoff |

5 883 |

– |

0 |

na |

||||||||||||||

Susanne Wamsler |

5 883 |

5 771 (correction of 5 883) |

964 1824 |

955 1714 |

||||||||||||||

Konstantin Winterstein |

5 883 |

5 771 (correction of 5 883) |

6 014 515 |

6 008 744 |

||||||||||||||

Former BoD members5 |

0 |

5 771 (correction of 5 883) |

na |

116 204 |

||||||||||||||

Total |

61 770 |

49 052 (correction of 50 004) |

7 159 397 |

7 223 080 |

||||||||||||||

The compensation for members of the Board of Directors is subject to the Swiss taxation and social security laws, with Clariant paying the employer contributions as required. The members of the Board of Directors do not receive any lump-sum reimbursement of entertainment expenses above and beyond actual expenditure on business trips. For additional information for the Board of Directors, refer to Note 14 of the Notes to the Financial Report of Clariant Ltd.

In 2016 no more options have been held by members of the Board of Directors, therefore no separate table is displayed. At 31 December 2015 Carlo G. Soave and Dominik Koechlin have held each 24 096 options.