Clariant wants to be an attractive employer with the ability to attract and retain qualified employees and experts throughout the world. In particular, Clariant’s compensation policy for management is based on the following main principles:

a) The level of total compensation should be competitive and in line with market conditions, and enable Clariant to recruit international, experienced managers and experts, as well as secure their long-standing commitment to the Group. Our understanding of competitiveness is defined in our Positioning Statement. We are aiming for a range between the median and upper quartile of total compensation in the relevant local markets. Through this ongoing benchmarking, we are able to define local compensation structures, e.g. annual pay bands, which will be applied as an important factor in all salary decisions. For the update and accuracy of market conditions, we participate in local compensation benchmarking in all major countries and align all activities through global contracts with the global compensation consultants Hay Group and Mercer. Mercer also has other assignments for Clariant, e.g. in the benefits area. In addition, we encourage local HR managers to participate in local compensation networks and club benchmarks within the chemical industry to ensure access to relevant market information.

Benefits |

Benefits represent local market practice and are aligned with Clariant’s global policies. |

|||

|

||||

Long-Term |

Investment reflects long-term commitment and supports our strong dedication to sustainable performance orientation. |

|||

Short-Term |

The annual cash bonus targets aim to be more aggressive than market norms. |

|||

Base Salary (BS) |

In general, we aim to be at median level in our respective markets and use different sources of compensation surveys (country-oriented, conducted by external consultants, including relevant peer companies in the chemical industry). |

|||

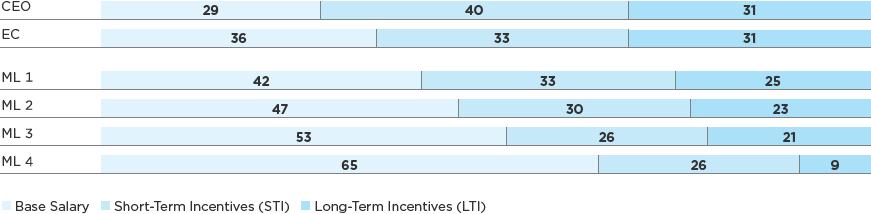

b) The structure of total remuneration should be highly performance- and success-oriented in order to ensure that shareholder and management interests are aligned. Clariant also defines in the global pay mix that with increasing responsibilities Short-Term and Long-Term Incentives will be increased. Success, in terms of bonus payouts, will generally be measured only in relevant financial Group Performance Indicators. Only if Clariant is successful, profits can be shared with our employees. Details are disclosed in chapter 3, Overview of existing bonus plans. Individual performance – measured through a consistent, global Performance Management system – is addressed in career development and annual salary reviews. Thus, each manager’s or employee’s performance is discussed on a yearly basis. In conjunction with other factors, such as internal and external market conditions, this results in transparency and consistent salary decisions. In general, we apply a four-eyes principle, which includes the involvement of the line manager and next level supervisor, for example, in addition to obtaining guidance from global or local HR processes.

Global Pay mix (Relative Structure) in % of total compensation

c) Compensation components should be straightforward, transparent and focused, so as to guarantee all participants (shareholders, members of the Board of Directors, the CEO, members of the EC, and all global Management Levels) the highest degree of clarity and objectives orientation.

In order to uphold these principles, the CoC analyzes and discusses market developments at regular intervals and considers the implications of these developments for Clariant. The Articles of Association (art. 26 ss) of Clariant Ltd – which have been approved in the AGM 2014 –therefore reflect Clariant’s commitment to market practice.