Integrated Reporting

In today’s complex markets, companies create value by considering and managing a wide range of resources, tangible as well as intangible, and financial as well as non-financial. Integrated reporting provides a more accurate and comprehensive account of how this process takes place.

Clariant’s integrated reporting takes inspiration from key elements of the International Integrated Reporting framework, developed and disseminated by the International Integrated Reporting Council (IIRC). The IIRC and others have engaged in global discussions about the importance of a more integrated approach to corporate reporting and have highlighted this framework’s potential for change.

Integrated reporting helps organizations clearly articulate how their strategy, processes, performance, prospects, and governance lead to the creation of value by utilizing and transforming different forms of capital. This supports shareholders and other stakeholders in making more informed decisions about their relationship with a company.

From an internal perspective, integrated reporting is both founded on and enhances integrated thinking within a company, encouraging active consideration of the relationships between various operating and functional units and the capitals the organization uses or affects. This supports integrated decision making that creates value over the short, medium, and long term.

Strong value creation for all stakeholders

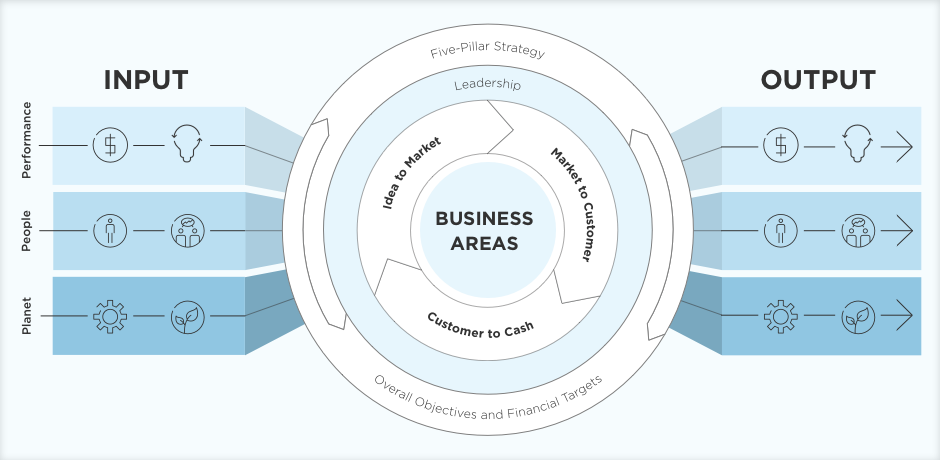

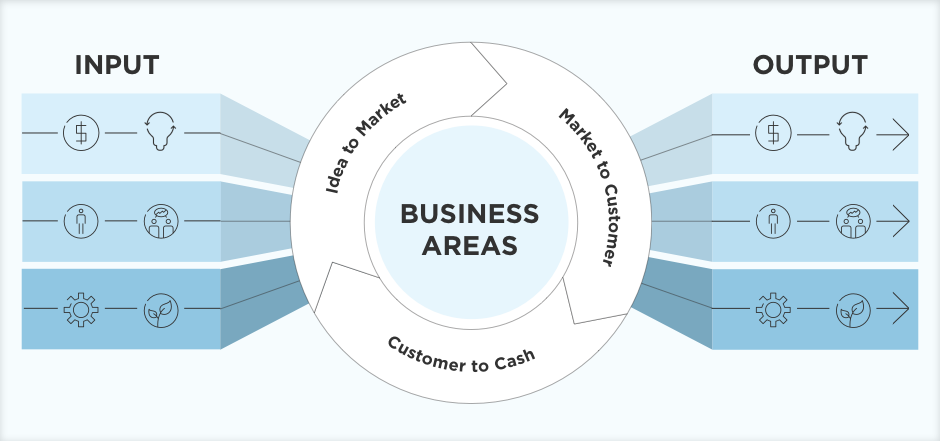

To create added value for its stakeholders Clariant employs six kinds of capital: financial, intellectual, human, relationship, manufactured, and natural. These six capitals are categorized under Performance (financial and intellectual capital), People (human and relationship capital), and Planet (manufactured and natural capital). Through Clariant’s unique business model, these inputs are converted into valuable outputs for customers, employees, shareholders, and the environment.

Clariant constantly engages with its stakeholders to stay attuned to their needs and gain feedback on how to best create value for them. In 2016, these engagements included customer surveys with 2 693 responses (chapter Market to Customer), investor updates and presentations at analyst and investor conferences, a global employee engagement survey with 11 000 responses (chapter Employees and Leadership), and the second Clariant Sustainability Dialog in Shanghai with over 200 participants (see chapter Objectives and Strategy).

The ultimate benefits Clariant’s business model offers its stakeholders include delivering on-time, in-full solutions to customers based on powerful R&D and innovation; providing above industry-average profitability, growth, and total return for shareholders; serving as a preferred employer that attracts and retains engaged and motivated employees; and adding value with sustainability. The company’s overall objectives (chapter Objectives and Strategy) firmly embed these beneficial outcomes for stakeholders within Clariant’s strategy process (chapter Objectives and Strategy).

Three phases turn challenges into opportunities

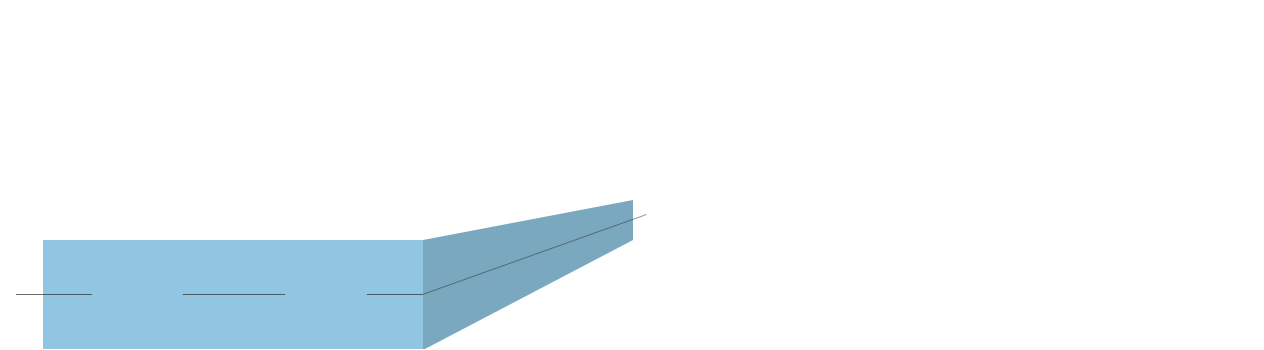

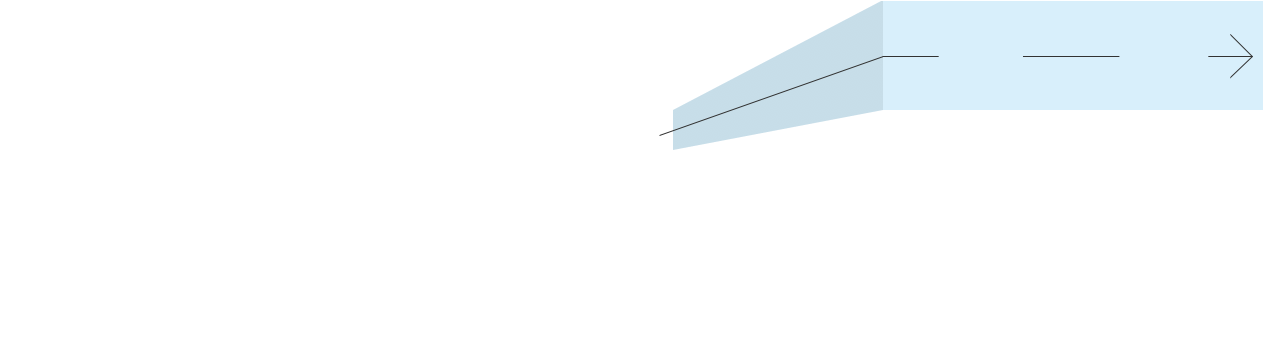

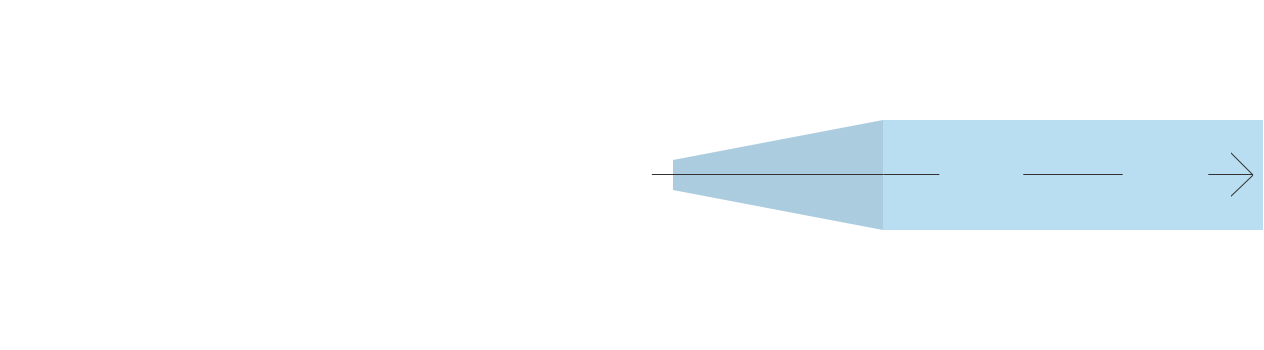

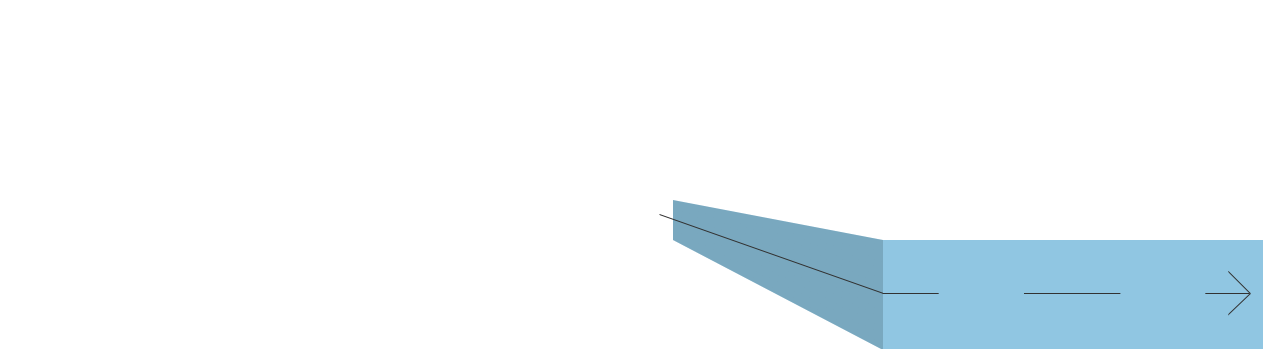

Within the company, the business model revolves around three key value-creation phases: Idea to Market, Market to Customer, and Customer to Cash. A well-filled innovation pipeline, customer-oriented sales and marketing processes, and efficient operations are key factors in achieving profitable growth. Externally, overarching societal trends, market drivers, and economic developments shape the environment in which the business model creates value.

The Group perspective on these external drivers is discussed further in the interview with Rudolf Wehrli, Chairman of the Board of Directors, and Hariolf Kottmann, CEO, (chapter Interview) and in the Strategy chapter, while the business area angle is explored in the chapters on the specific business areas (chapters Care Chemicals, Catalysis, Natural Resources, and Plastics & Coatings).

Clariant helps to solve global societal and environmental challenges by taking an outside-in approach and viewing unmet stakeholder needs and global challenges as business opportunities. As discussed throughout the report, a clear strategy with ambitious objectives, a strong leadership culture focused on entrepreneurship, and leading businesses in four areas ensure that Clariant’s strong foundations are consistently translated into sustainable growth.