Decoding Chinese beauty

Contribution to SDGs

This story is an example of Clariant’s contribution to SDG 3 and SDG 15. Read more in Sustainable Development Goals

-

Ensure healthy lives and promote well-being for all at all ages

-

Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss

The Chinese beauty market is growing and evolving. Brands vying for a share need to understand both natural actives and the consumers that buy them.

The video is shaky, obviously filmed on a smartphone. But what Fang Junping lacks in production value, he easily makes up for in confident charm. His lab coat lends an additional air of scientific authority as he explains to a giggling woman off camera what goes into her whitening cream. It’s one of Fang’s early videos that went viral on Weibo, China’s answer to Twitter. And it’s what kick-started his career as a KOL, or »key opinion leader,« as China’s internet influencers are called.

Today, Fang (better known by his online alias »Junping Big Devil«) has over 8.7 million followers on Weibo. His videos are snappy and better lit these days but their premise is unchanged. Fang is part of a movement of self-proclaimed chen fen dang (成分党), which loosely translates to »ingredient geeks.« They claim to scientifically decode the ingredient lists of popular cosmetics and to let consumers in on what really works and why. Their audience is huge and eager to learn. And the industry itself is paying attention.

The Chinese cosmetics market is the world’s second largest, topped only by the United States. And it just keeps on growing. According to Euromonitor, a market research firm, Chinese consumers spent over 212 billion yuan, or around CHF 30 billion, on skincare products in 2018. That is a year-on-year growth of more than 13%. What’s more, Euromonitor sees unmet potential worth over CHF 133 billion in retail sales for beauty and personal care overall. No wonder the industry and most global brands have turned to China for growth. However, Chinese consumers are very particular about what they want. And, as ingredient geeks will tell you, they won’t be fooled by simple marketing jargon.

According to a 2018 study by Clear, a global marketing strategy consultancy, 69% of Chinese skincare consumers are willing to pay a premium for natural ingredients. At the same time, other studies show that effectiveness is their top priority. »Ten years ago, Chinese consumers might have gone for a product, say a skin cream, because it contained some floral extract that appealed to them on an emotional level,« says Christoph Yu, Head of Marketing for China and Asia-Pacific for the Business Unit Industrial & Consumer Specialties (ICS) in Shanghai. »Today, they want to know exactly what it promises to do to their skin on a cellular or even a molecular level. They still want natural ingredients. But they want science and high tech on top of that.« Clariant’s Active Ingredients business, a subdivision of ICS, caters to those tastes. Its claim: »Powered by nature. Advanced with science.«

CHINA & SOUTH KOREA

Shanghai

Urbanization is reshaping Chinese society. It also drives new trends in personal care.

Christoph Yu

Head of Marketing China and Asia-Pacific, Business Unit Industrial & Consumer Specialties

Unique natural extracts

Active Ingredients was only established in 2017. It specializes in natural extracts that tackle very specific cosmetic issues. The offices of the business are located in the French city of Toulouse. That’s also where it does most of its research to establish and substantiate product claims. But ever since Clariant joined forces with BioSpectrum, a Korean manufacturer of active ingredients, the company has had a strong foothold in East Asia too. That has proven especially helpful in finding naturally occurring molecules that not only show the desired effect but will also resonate with Asian consumers.

Many of the natural extracts Active Ingredients sells are sourced on Jeju, a volcanic island off the coast of the South Korean mainland. It is home to several world heritage sites and more than 1 800 different plant species – many of which don’t grow anywhere else. »The plant extracts we find on Jeju are very unique in their composition, but the plant species themselves are also well known in Traditional Chinese Medicine,« says Sophia Kim. »Add to that our highly scientific approach to establishing and substantiating their beneficial effects on the skin, and you have a package that chimes well with Asian and especially Chinese consumers.« Kim recently joined Clariant’s Active Ingredients team as a Business Development Manager for Asia-Pacific. She has close to a decade of experience in the actives industry as well as degrees from Korean, Chinese, and American universities. Bridging cultures is part of her job for Clariant too. She works closely with Yu and the ICS marketing team in Shanghai but is herself based in Seoul.

South Korea has in recent years emerged as one of the most innovative cosmetics markets worldwide, alongside Japan and France. K-Beauty, as it’s widely known, has garnered huge attention with »a certain gentle, nature-meets-technology ethos,« as the Wall Street Journal once described it. Women – and some men – all over the world have adopted elaborate multistep K-Beauty skincare routines. The idea being that the right treatment can create a complexion so healthy, even, and beautiful that there is no need to hide anything with concealers and foundations.

»China is really close to South Korea, and not just geographically,« says Kim. »We’re dealing with very similar skin types and hair structures. Consumers in both our countries are deeply familiar with Traditional Chinese Medicine, and they’re concerned about some of the same environmental factors that cause skin irritation and premature aging.«

New markets

Going beyond China

Sophia Kim

Business Development Manager Asia-Pacific for Active Ingredients, Business Unit Industrial & Consumer Specialties on expanding Chinese brands and some specific needs in South Asia

Sophia, with the Chinese beauty industry growing and innovating so fast, do you see its domestic brands going global?

It is definitely possible to see trends coming from China in the future. Today, Chinese consumers still very much look to South Korea and Japan for trends, and I don’t see K-Beauty and J-Beauty being replaced by »C-Beauty« anytime soon. However, that doesn’t mean Chinese brands aren’t expanding abroad.

Where else are Chinese brands making their mark?

We see them doing well in India, for example. That’s a sizeable emerging market where the Chinese are very competitive. And Chinese brands are strong in countries like Malaysia and Indonesia. These countries are promising if you can adapt and cater to their unique requirements.

What are some of the different needs in these countries?

Price is one thing, obviously. But take Indonesia, the world’s most populous Muslim country. Here, it’s vital to address specific consumer needs. When wearing a hijab, for example, you need to treat your hair and scalp very differently. And brands have to document that all their ingredients and production processes meet local halal requirements. That’s another thing Clariant can help its customers with.

Wary of air pollution

One traditional concern particular to China and some of its surrounding countries is protection against UV rays, but not just because they are a major cause of skin damage and premature aging. A pale, white complexion is seen as the hallmark of a glamorous woman in China. Darker-skinned women can even feel stigmatized. As a result, lightening and whitening products are a huge market. And Clariant’s Active Ingredients does offer natural products that help repair the damage done by UV light and can even lighten the skin naturally by, for example, reducing the synthesis of pigment in the skin’s melanocytes. However, the business has recently focused on skin issues that are more specific to modern life in urban China.

»Anti-pollution skincare is a big trend,« says Christoph Yu. »People are very much aware of the impact that airborne pollutants have on their health and their skin in particular.« Clariant’s answer to this is called RedSnow®. It’s a natural active ingredient derived from floral extracts of Camellia Japonica, the common camellia. »We use a very unique variety grown on Jeju Island,« says Kim. »It’s not just a beautiful red flower that actually blooms in winter, hence the trademarked name. It’s also especially rich in the type of molecule we look for.« To put that in ingredient geek terms: RedSnow® contains protocatechuic acid, a type of phenolic acid with strong antioxidant properties. It also blocks the cell’s aryl hydrocarbon receptors, or AhR, which are triggered by pollutants such as particulate matter and heavy metals in the air. In short, RedSnow® helps if bad air makes your face red and itchy. Another active ingredient, called Eosidin®, specifically targets the negative effects of indoor pollution. It’s derived from a certain variety of unripe citrus. These are gathered during pruning and previously went unused, which makes Clariant’s product especially sustainable.

»These products have gotten a lot of attention because they are highly effective, but also because they tell a great story,« says Alexandre Lapeyre, Global Technical Marketing Manager for Active Ingredients. Stories matter. They help brands stand out. That’s especially important to up-and-coming local brands in China. »There’s a huge difference between today and when I was visiting Chinese trade shows eight or even five years ago,« says Lapeyre. »They’re teeming with emerging local companies that have great booths and very professional marketing. They’re really inspiring to talk to.« The top three global players in China, Procter & Gamble from the United States, L’Oréal from France, and Shiseido from Japan, together take up a significantly smaller share of the market in China than they do globally. Homegrown and small brands are strong. Yu sees these »local heroes,« as he calls them, as especially nimble and open to new consumer needs. »They are our main customer base in China, and they’re extremely agile. These companies really have their ear to the ground,« he says. The fact that Chinese consumers tend to be less loyal to brands in general and more open to innovation works in their favor.

New technology

Milking plants

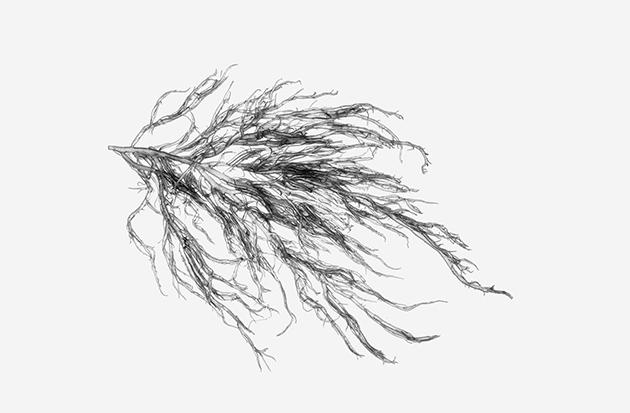

Growing plants in aeroponic conditions allows PAT to harvest active natural compounds directly from their roots.

A new collaboration helps Clariant discover new active ingredients and makes harvesting them more sustainable.

Plants absorb and store vital nutrients in their roots. So it is no surprise that these roots often are also especially rich in some of the biochemical compounds that can prove valuable in cosmetics and pharmaceuticals. Even so, roots are often overlooked as a source for active ingredients. One reason is that they are harder to harvest than stems, leaves, and fruits. And they are almost impossible to obtain without destroying the whole plant, which makes their harvest less sustainable. Clariant’s latest strategic collaboration in research and development is set to change that.

In 2019, Clariant joined forces with Plant Advanced Technologies (PAT) based in Nancy, France. As a university spin-off, PAT has perfected technologies to harvest plant extracts directly from the root. For one, PAT cultivates its plants in aeroponic conditions without the use of soil or any other substrate. That way, the roots stay easily accessible. PAT’s proprietary milking technology then encourages the roots to synthesize the desired phytochemicals directly. This not only yields especially high concentrations and more active extracts than any other method, but it is also nondestructive and thus allows for several harvests per year. That way, PAT is able to produce natural extracts with a substantially smaller ecological footprint and does not compete with agricultural food production.

Never too young for antiaging

Digitalization is another reason why smaller brands are making their mark. Social media and e-commerce are huge in China. Here, the battle is not about shelf space, but more about attention. The role of department stores and traditional advertising is shrinking. And that’s true not just for the young generation. The silver economy of affluent consumers is growing, and seniors are surprisingly tech-savvy. According to Daxue Consulting, around 64% of seniors on JD.com, Chinas second largest online retailer, do their shopping on mobile devices. Meanwhile, China’s young and mostly less affluent »skintellectuals« invest a significant proportion of their salary in skincare. But they pour even larger chunks of their free time into researching the most effective ingredients and the best deals – relying on KOLs to guide the way. Most recently, highly concentrated active ingredients have been creating a buzz on Chinese search engines like Baidu.

One thing that apparently never goes out of fashion in China is antiaging. While some parts of the Western world proclaimed »the end of antiaging,« with brands adopting age-positive messages, China is still obsessed with eternal youth. A common refrain is that Chinese women are never too young for antiaging. The hope is to maintain a youthful appearance by starting young and investing early.

Superfood of the sea

Laminaria japonica is a staple both in Traditional Chinese Medicine and in many cuisines across East Asia.

Alexandre Lapeyre

Global Technical Marketing Manager for Active Ingredients, Business Unit Industrial & Consumer Specialties

Clariant’s most recent innovation, called Epseama®, ties all these trends together. It’s the first active ingredient to directly target a long non-coding RNA in order to fight three main causes of aging: photoaging, chronoaging, and inflammaging. And of course it’s derived from natural sources. In this case, it’s Laminaria japonica, a brown seaweed or kelp. As »kombu,« it’s a staple in Traditional Chinese Medicine as well as in many cuisines across East Asia. »It’s sometimes referred to as ›the superfood of the sea‹ because it’s so full of vitamins and minerals,« says Kim. Clariant uses sustainable »ugly-food« sourcing by purchasing only the cuts that aren’t square and regular enough for the food market. »Looks don’t matter to us because, in Epseama®, we use an extract that works on a much deeper level,« says Kim. »It contributes to boost the expression of a certain long non-coding RNA called nc886, which in women commonly decreases significantly after the age of 40.«

RNA, or ribonucleic acid, is central to any cellular activity, and nc886 has been found to play a role in collagen production, which is vital for smooth and supple skin. Or as the Epseama® brochure puts it, »the expression of nc886 inhibits the production of MMP-9, a collagenase that degrades collagen IV and increases the production of collagen IV, VII, and XVII, which are key components of the dermis-epidermis junction.« Now, there’s something for »Junping Big Devil« and his fellow ingredient geeks to decode!

Pigments are substances used for coloring; they are used in a technical manner, for example in the manufacture of dyes, varnishes, and plastics. View entire glossary

A spin-off refers to the creation of an independent company through the divestment of a business unit from a company. Clariant was created through the spin-off and subsequent IPO of the Chemicals Division of Sandoz. View entire glossary