Performance Progress in profitability

»Clariant aspires to be one of the leading specialty chemicals companies in the world by means of continued improvement in profitability and cash flow generation.«

Patrick Jany

Chief Financial Officer

»Clariant aspires to be one of the leading specialty chemicals companies in the world by means of continued improvement in profitability and cash flow generation.«

Patrick Jany

Chief Financial Officer

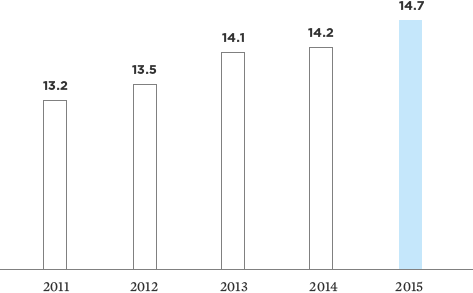

Despite a challenging economic environment and unfavorable currency developments, Clariant was able to achieve the financial targets for the business year 2015. Sales in local currencies improved by 3%. The EBITDA margin before exceptional items, the key performance indicator for the Group’s profitability, increased by 50 basis points to 14.7%. Additionally, the cash flow from operating activities reached CHF 502 million, 50% above the previous year’s level.

These are successes that all employees in the Group can be proud of. For the future, the company has set a goal for further sustainable improvement in performance by which Clariant can be measured.

in %

1 before exceptional items

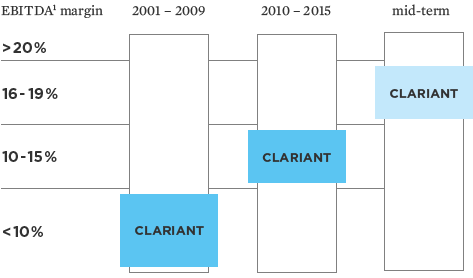

Clariant expects another challenging environment for the business year 2016. Nevertheless, the company is confident to be able to post further sales growth in local currencies as well as further improvements of the EBITDA margin before exceptional items and the operating cash flow. Based on these assumptions Clariant is well on track to reach its mid-term targets of an organic sales growth above global GDP growth, an EBITDA margin range between 16% and 19% before exceptional items, as well as a return on invested capital (ROIC) above the peer group average.

1 before exceptional items

The EBITDA margin is calculated based on the ratio of EBITDA to sales and shows the return generated through operations from sales before depreciation and amortization. VIEW ENTIRE GLOSSARY

Exceptional items are defined as non-recurring costs or income that have a significant impact on the result, for example expenses related to restructuring measures. VIEW ENTIRE GLOSSARY

Exceptional items are defined as non-recurring costs or income that have a significant impact on the result, for example expenses related to restructuring measures. VIEW ENTIRE GLOSSARY