Cash flow before changes in net working capital decreased from CHF 583 million the previous year to CHF 570 million.

The lower net income after reversal of non-cash items of CHF 687 million (previous year: CHF 730 million) was almost compensated by lower payments on restructuring (CHF –78 million vs. CHF –89 million the previous year), lower income tax paid (CHF –96 million vs. CHF –108 million the previous year) and higher dividends received from associates and joint ventures (CHF 57 million vs. CHF 50 million the previous year).

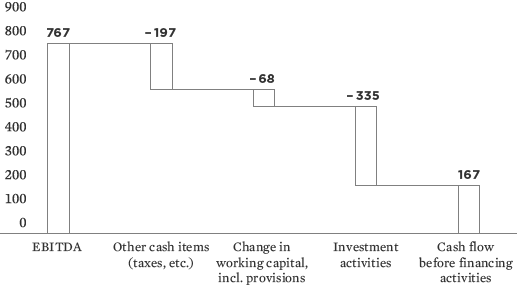

Changes in net working capital including provisions amounted to CHF 68 million in 2015 (2014: CHF 249 million). The ratio of net working capital to sales declined from 19.1% to 17.7%, which is substantially below the Group’s target of 20%.

Cash flow from operating activities significantly increased to CHF 502 million versus CHF 334 million the previous year, resulting from the sustainable net working capital management.

Cash flow from investing activities decreased sharply to CHF –335 million (2014: CHF 31 million). This figure was influenced by higher capital expenditures and lower cash flow from sales of assets and disposals of discontinued operations.

Cash flow before financing activities amounted to CHF 167 million at the end of 2015 compared to CHF 365 million in fiscal year 2014. The outflows from financing activities were CHF 84 million (2014: CHF 403 million) primarily influenced by proceeds from and repayments of financial debts.

CASH FLOW 2015

in CHF m

|

31.12.2015 |

31.12.2014 |

||

Net Income |

239 |

217 |

||

Reversals of non-cash items |

448 |

513 |

||

Cash flow before changes in net working capital and provisions |

570 |

583 |

||

Operating cash flow |

502 |

334 |

||

Cash flow from investing activities |

–335 |

31 |

||

Cash flow from financing activities |

–84 |

–403 |

||

Net change in cash and cash equivalents |

41 |

–22 |

||

Cash and cash equivalents at the beginning of the period |

748 |

770 |

||

Cash and cash equivalents at the end of the period |

789 |

748 |

Economic indicator representing the operational net inflow of cash and cash equivalents during a given period. VIEW ENTIRE GLOSSARY

Net working capital is the difference between a company’s current assets and its current liabilities. VIEW ENTIRE GLOSSARY

Joint ventures are all activities in which Clariant is involved with another partner. The accounting method applied for joint ventures depends on the specific conditions of the participation. VIEW ENTIRE GLOSSARY

Net working capital is the difference between a company’s current assets and its current liabilities. VIEW ENTIRE GLOSSARY

Economic indicator representing the operational net inflow of cash and cash equivalents during a given period. VIEW ENTIRE GLOSSARY