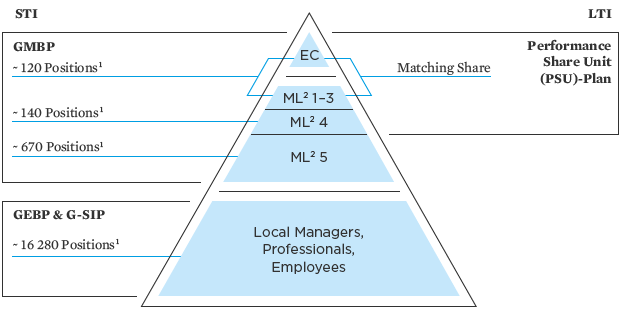

During the previous years, all relevant bonus plans for Short-Term Incentives (STI) and Long-Term Incentives (LTI) have been reviewed and redesigned to ensure the transition of Clariant, and to align with the business model. The key principles have been to reduce complexity, increase transparency, and ensure a coordinated and unified »One Clariant« approach throughout all employee groups and countries.

The following variable programs are currently in place for Clariant:

3.1. STI: Short-Term Incentive Plans (cash bonus)

a) Group Management Bonus Plan (GMBP) – started in 2010

b) Group Employee Bonus Plan (GEBP) – started in 2010/2011

c) Global Sales Incentive Program (G-SIP) – started in 2011

BONUS LANDSCAPE

of Clariant

3.2. LTI: Long-Term Incentive Plans (equity-linked bonus)

a) Performance Share Unit (PSU) Plan – started in 2013

b) Group Senior Management – Long-Term Incentive Plan

(GSM-LTIP or Matching Share Plan) – started in 2010

c) Restricted shares for the Board of Directors – started in 2012

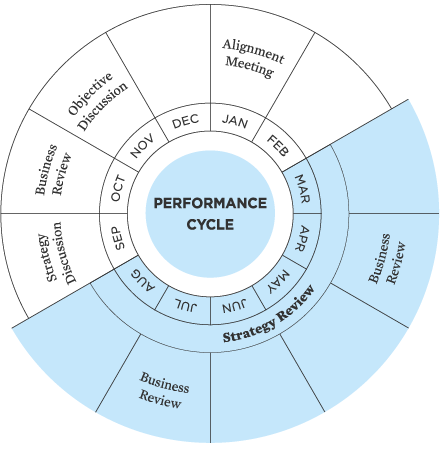

The Performance Cycle of Clariant is based on a 12-month rotation, which starts in November each year with objective discussions focusing on the next business year. Group Performance Indicators (GPI), top priorities and related projects are included. In January, alignment meetings take place with key leaders of the company in order to cascade GPI objectives and priorities for the new year.

GENERIC PERFORMANCE CYCLE

of Clariant

3.1. Short-Term Incentive Plans (cash bonus)

a) The Group Management Bonus Plan (GMBP) is anchored in the overall performance cycle at Clariant. Through intensive discussions and systematic alignment meetings, this cycle ensures a challenging business-specific target agreement for each Business Unit and Service Unit (BU/SU).

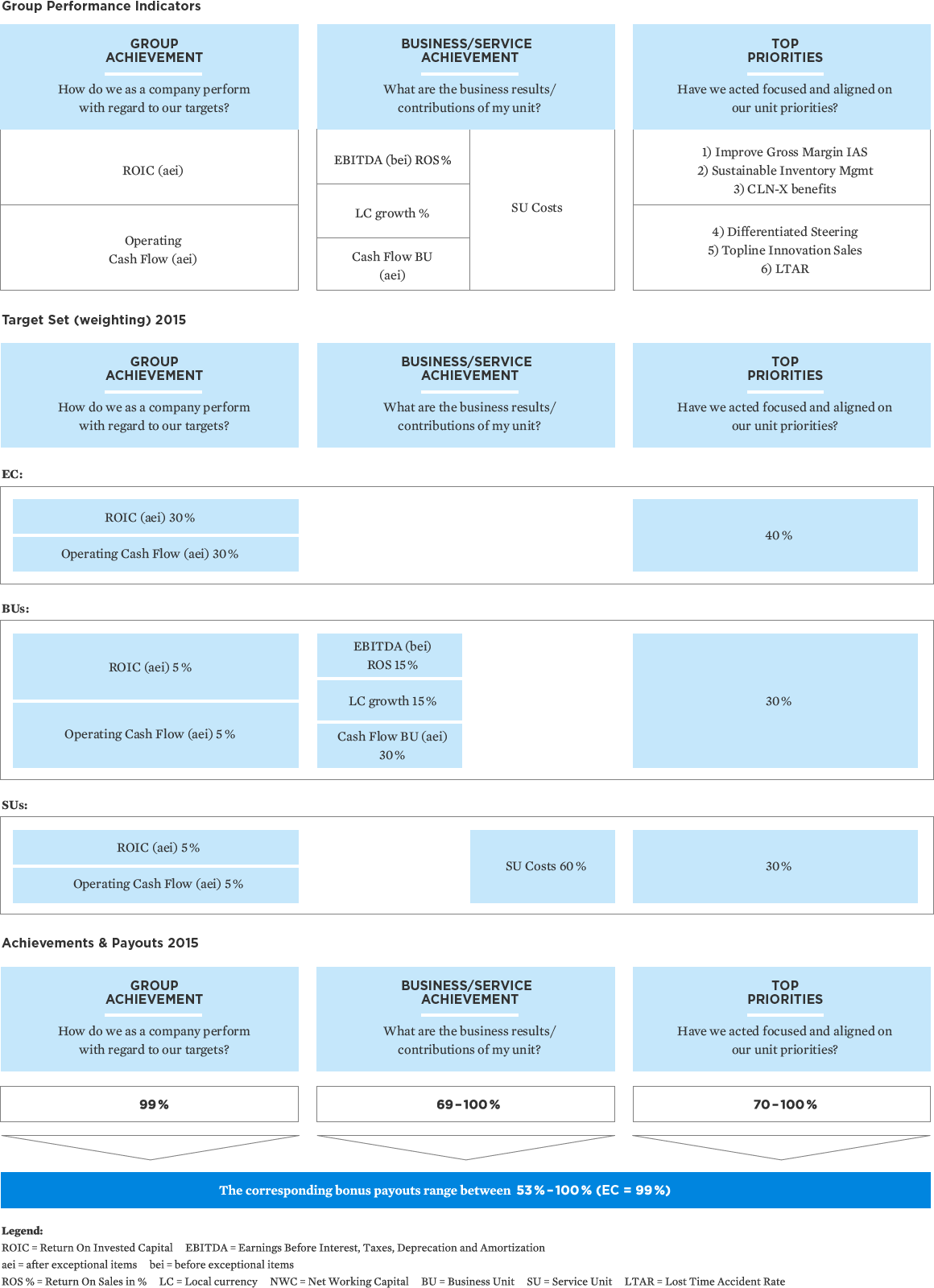

The individual amount of bonus payments generated in a year is determined by the achieved result of the Clariant Group measured against clear objectives. The achievement is calculated by means of three elements: financial result of the Group; financial results of Business and Service Units; and defined top priorities (Group Performance Indicators and strategic projects).

As Clariant Performance Cycle agreements with each BU lead to challenging business-specific target settings, and in order to exclude any »windfall profiting« or »hidden buffers«, the maximum bonus payout is explicitly capped at 100% (= target). These target settings have been defined in the fourth quarter of 2014 and there was only a review in February due to the special impact of the Swiss franc currency situation after the Swiss National Bank’s decision to abandon the euro - Swiss franc floor. As outlined in our compensation concept, we aim for a more aggressive pay-mix than is the norm in international markets; thus, this 100-percent approach ensures competitive positioning compared with other companies.

GROUP MANAGEMENT BONUS PLAN (GMBP) 2015 –

Three pillars to balance the Bonus Plan

As a principle, only collective/management team-related target achievements can serve as the basis for individual bonus payouts. An employee’s individual performance will be honored in the annual review of total compensation and his/her career development. The prerequisite for this is an integrated People Performance Management, which plays a key role in building a High Performing Workforce and High Performance Culture – as defined in our People Excellence Strategy. In 2012, an adjusted People Performance Cycle was re-launched, including 360-degree feedback for all ML 1 – 5 grades.

The annual evaluation of the achievement of objectives and allocation of funds for the GMBP is conducted by the CoC in February, following the financial year in question, and approved by the Board of Directors. This system ensures that the bonus payments made to employees are closely aligned with the Group’s overall results.

b) Cash bonus for non-management-levels: The Group Employee Bonus Plan (GEBP) ensures further alignment and standardization to all local bonus plans of the legal entities around the world. In general (where legally compliant and possible), all legal entities will apply the global Group Achievement or a combination of Group results and local Top Priorities as the bonus payout.

c) For the sales force: The Global Sales Incentive Plan (G-SIP) aims to establish dedicated and globally aligned local Sales Incentive Plans (SIPs) for all Sales Representatives, Sales Managers and Key Account Managers with clearly allocated annual sales budgets and commercial responsibilities (ML 1 – 4 excluded). The G-SIP focus is on the individual sales performance and underlying Key Performance Indicators in the areas of sales, margin and trade receivables. As an example, a Sales Representative will receive tailor-made individual objectives for his allocated set of clients, which means a concrete sales target in local currencies, a »Deal Score« target, as an important indicator to measure the margin, and overdues and receivables as an indicator for trade receivables. Each objective is weighted and can be monitored using existing reporting systems. Thus, the direct impact of individual success and payout can be easily calculated. In 2011 the global roll-out started, and in 2015, approximately 1 100 employees from every region were included. Employees can participate only in one global bonus plan (G-SIP or GMBP/GEBP).

3.2. Long-Term Incentive Plans (equity-linked bonus)

Clariant uses equity-based income components for approximately 280 of its senior managers worldwide (EC and ML 1 – 4).

a) The Performance Share Unit (PSU) Plan was introduced in 2013 for all senior managers and replaced the former Tradable Option Plan (»TOP@Clariant«). Key objective is a strong commitment to a higher profitability for Clariant and therefore to achieve our 2015 strategic targets.

The term of Clariant’s Performance Share Unit Plan is a three-year vesting period. The vesting is conditional upon achievement of the performance target (check after three years). The relevant underlying Key Performance Indicator is EBITDA (before exceptional items) in percentage of sales and the performance target is to be at or above median of a defined peer group. The peer group was adjusted to replace companies which have disappeared due to M&A activity (AZ Electronics and Rockwood) and to strengthen the Asian focus (new: Jiangsu Yoke, Teijin and Toray). If vesting and performance targets are achieved, one PSU will be converted to one Clariant share. The first PSUs were granted in 2013 and in Summer 2016 performance criteria will be checked (vesting in September 2016).

Membership is limited to the Executive Committee and selected senior managers of ML 1 – 4 (approximately 1.7% of employees). Eligible participants will receive a fixed number of PSUs, in accordance with an underlying share price defined over a 10-day trading period. Eligibility and endowment will be reviewed each year that the scheme is in operation. For 2015, it was decided in March to grant PSUs for 2015. The underlying share price was CHF 19.10. The grant was endorsed on 16 September 2015.

If an employee should voluntarily leave Clariant before the vesting period (three years) expires, all rights to shares which have not yet been transferred at that point in time become invalid. In case of retirement, disability or death of the participant, the employees (respectively the estate and /or heirs of the participant in case of death) will receive an immediate vesting on a pro-rata basis, in accordance with published regulations. The vested PSUs remain subject to the performance condition and will be allocated only at the end of the vesting period.

AkzoNobel |

EMS |

Mitsui |

||

Albermarle |

Evonik |

Omnova |

||

Altana |

Ferro |

Polyone |

||

Ashland |

H & R |

PPG |

||

Axiall |

HB Fuller |

Schulman |

||

BASF |

Honeywell |

Sherwin Williams |

||

Borealis |

Huntsman |

Shinetsu |

||

Braskem |

ICL |

Solvay |

||

Cabot |

Jiangsu Yoke |

Symrise |

||

Celanese |

Johnson Matthey |

Teijin |

||

Chemtura |

Kemira |

Toray |

||

Croda |

Kraton |

Umicore |

||

Cytec |

Lanxess |

Valspar |

||

DIC Dow |

LG Chemicals |

Wacker Chemie |

||

DSM |

Lonza |

West Lake Chem |

||

DuPont |

Lyondell Basell |

WR Grace |

||

Eastman |

Mitsubishi |

|

b) Group Senior Management – Long-Term Incentive Plan (GSM-LTIP) = Matching Share Plan

The Matching Share Plan requires a personal investment decision and fosters the commitment of key managers (approximately 120 positions; EC and ML 1 – 3) for the long-term success of Clariant. Under this plan key managers have to invest part of their compensation in Clariant shares. Thus, this plan supports senior managers in meeting their requirement to permanently hold a minimum of 20 000 up to 100 000 shares depending on their management level. New participants will now have six years to catch up to the required investment thresholds.

Under the plan, eligible senior managers are entitled to receive a certain fixed percentage (investment quota of 20%) of their annual cash bonus for the respective bonus year in the form of investment shares. Title and ownership in the shares are transferred at allocation (grant in April 2015) of the investment shares. These investment shares will then be blocked and held in a custody account for a period of three years. At the end of the blocking period, the participant is entitled to obtain for each investment share an additional share free of charge (matching share). This matching is subject to the condition of continued employment with Clariant throughout the blocking period. In case of termination of employment before the end of the blocking period, the right to matching shares lapses and a cash amount will be paid instead, equal to the pro rata temporis portion (considering employment during the blocking period).

The senior managers who do not participate in this plan, or do not invest according to the plan regulations, will forfeit 50% of their annual cash bonus (with minimum level at 40% of target cash bonus) and the eligibility to participate in any Long-Term Incentive Programs (including PSU Plan).

The decision to implement this plan was made to create a strong and sustainable link between the Clariant business cycle and the value development of the company. Senior managers therefore strengthen the entrepreneurial and value-creating spirit of the Clariant Group.

c) Restricted shares for the Board of Directors

This share plan introduced in 2012 allocates shares of Clariant Ltd to members of the Board of Directors. Board Members will receive a fixed portion of the annual fee allocated in the form of shares subject to a blocking period (»Restricted Shares«). The blocking period is three years from the date they are allocated. From the first business day after the blocking period, the Board member may freely dispose of and trade these shares without any further restrictions (legal restrictions will remain applicable). The allocation is made once a year, at the end of the mandate year, four weeks prior to the Annual General Meeting (AGM).

The value of a grant is determined by the role and responsibility:

Chairman of the Board |

CHF 200 000 |

|

Vice Chairman |

CHF 150 000 |

|

Member of Board |

CHF 100 000 |

Earnings before interest, taxes, depreciation, and amortization. VIEW ENTIRE GLOSSARY

Exceptional items are defined as non-recurring costs or income that have a significant impact on the result, for example expenses related to restructuring measures. VIEW ENTIRE GLOSSARY

Management body of joint stock companies; at Clariant the Executive Committee currently comprises four members. VIEW ENTIRE GLOSSARY