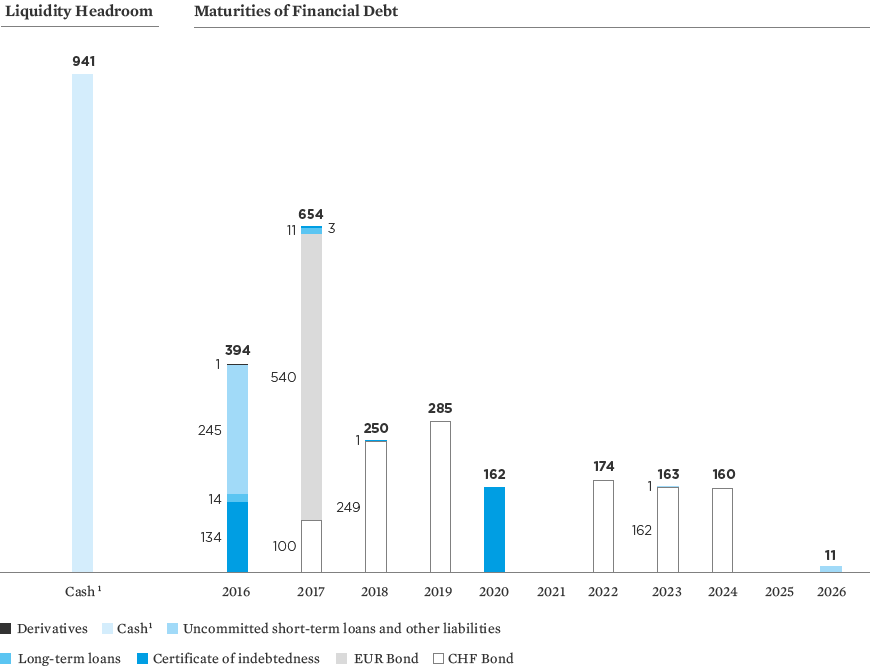

In the fiscal year 2015, Clariant’s financing structure was again on a very sound level. The company has a broadly diversified maturity structure of its financial liabilities with a long-term focus reaching until 2024. The Company was able to secure this with favorable financing terms. On 17 April 2015, Clariant issued four certificates of indebtedness with a total sum of EUR 300 million. These certificates have a term of 5 years (EUR 150 million) and 8 years (EUR 150 million).

DEBT MATURITY PROFILE PER 31 DECEMBER 2015

in CHF m

Two credit rating agencies maintain credit ratings for all six bonds issued by Clariant: Moody’s assigned the bonds a long-term rating of Ba1. Standard & Poor’s long-term rating for the bonds is BBB–. The most up-to-date ratings can be found on the following website: www.clariant.com/creditratings

A rating assesses the creditworthiness of a debtor. Ratings are mainly required for the issue of debt instruments and usually determine the level of necessary interest payments, among other things. Clariant currently uses the two rating agencies, Moody’s and Standard & Poor’s, for this purpose. VIEW ENTIRE GLOSSARY

A rating assesses the creditworthiness of a debtor. Ratings are mainly required for the issue of debt instruments and usually determine the level of necessary interest payments, among other things. Clariant currently uses the two rating agencies, Moody’s and Standard & Poor’s, for this purpose. VIEW ENTIRE GLOSSARY